beginner's finance management

2024-11-07 13:57:40 140 0 Report 0

0

Login to view full content

Other creations by the author

Outline/Content

Things You Need to Know When Managing Your Own Finances

Business Cycle

The composition of GDP: household consumption, investment, government spending, and net trade income.

Taking inflation into account, real GDP is equal to nominal GDP divided by the average price index.

Recovery period: Buy stocks at the bottom, especially daily consumer enterprises; Buy land and buildings, open coffee shops or clothing stores

Uptrend: Stock trading

The expiration date: sell the house, sell stocks, lend money

Declining phase: Focus on investing in bonds

Bottoming out: Buy stocks

How to determine the stage of the economic cycle

Real GDP growth

PMI (Purchasing Managers' Index): The origin is 50, official PMI and HSBC PMI; lagging indicators, used to confirm the previous judgment of the economic stage.

Core CPI: Remove the factors of food and energy from the CPI index

The unemployment rate: Judged and confirmed by the PMI index.

Foreign exchange rate:

Deposit interest rate: the central bank stipulates the benchmark deposit interest rate and floating range; tighten the money supply.

Stock Index: Composite, Component, Sector, Style (High Growth, Value, Overbought)

Investment style

Value Investing

Growth investment

Technical analysis investment: moving average analysis, K-line analysis, etc.

Behavioral Psychological Investment: Investment Behaviorology

Financial tools

Hedging

Medium risk: Set stop-loss and take-profit points

High risk: Stock derivatives include stock options, stock index futures, and margin trading; short selling and securities lending; stock index futures and margin, forced liquidation

Credit Card Finance and Leverage Finance

Capital leverage (such as margin trading related to stocks, futures, and foreign exchange), financial leverage (such as borrowing)

Financing channels

Stock margin financing: 3 to 5 times the margin

Margin trading and securities lending business

Credit loans and mortgage loans

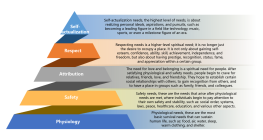

50% to 70% for capital preservation, no more than 20% for stocks and precious metals, no more than 10% for high-risk, 10% to 20% cash or money market funds.

Internet Finance

P2P

The 327 Treasury Bond Futures Incident and the Regulatory Strength of Internet Finance

Payment Methods: Lump sum, Installments (Principal first, Interest first, Equal principal and interest, Interest first and principal last)

P2P Guarantee Methods: Third-party Guarantee, Establishment of Risk Reserve Fund, and Cooperation with Insurance Companies (Credit Insurance with Minimum Risk)

Big Data and Finance: Suitable Financial Methods for You, Online Credit Statistics, Cash Management

Hire someone to manage your finances.

Evaluating a financial product: attack power (profitability), defense power (safety), style, mobility (investment cycle), power exertion (stability), troop size (capacity), battle record (past history), and command ability (operators).

How to choose financial products

Know the enemy: The goal of ordinary investors is to beat CPI.

Confidant: Risk, current cash pressure, medium- and long-term cash needs

Conservative investment

Precious metals, foreign exchange, money market funds, microloans, insurance, corporate bonds

Structured: Money market funds + corporate bonds > stocks + precious metals + foreign exchange, etc.

The subprime crisis: the safety of high-quality bonds and the profitability of subprime loans constitute structured investment.

Guaranteed principal and interest type: The product brochure clearly states the interest portion.

Capital Preservation Floating Income Type: "Wave Operation" of Gold Investment; The product brochure specifies the income range

Non-principal-protected

Collective Finance: In addition to purchasing risk-free assets, securities companies can use about 20% of their funds to purchase stocks, corporate convertible bonds, and index funds; there are a few "settlement window periods" every month.

New share funds: offline subscription and online subscription

QDII Funds: Real Estate, Index, Mature Markets, Global, Asia-Pacific, Bond Markets, Emerging Markets, Commodities, Resources

Fund

Revenue sources: stocks, bonds, currency, overseas investment; there are "one falls and the other rises" opportunities in the stock market and bond market.

Buy institution's own products rather than agency products

Online Purchase

ETF (Exchange Traded Fund): All funds are used to buy stocks based on stock indexes.

Comprehensive Index: Shanghai Stock Index, A-share Index, B-share Index, Industrial Index, Commercial Index, Real Estate Index, Public Utilities Index, GEM Index, SME Board Index

Component Index: CSI 300, SSE 180, SSE 50, SZSE 100,

Industry Index: Shanghai Energy, Shanghai Industry, Shanghai Consumption

Theme Index: Dividend Index, Central Enterprise Index

Style Index: 180 Growth, 180 Value

Main ETF Fund

Pegged to the Growth Enterprise Market Index

E Fund ChiNext Board ETF

Guotai SME Board 300, Huaxia SME Board ETF, Guangfa SME Board 300

Guotai Shanghai Stock Exchange 180 Gold

LOF Fund (Listed Open-Ended Fund): It can also be purchased offline; It is not only linked to stock indexes, but also to the stock pool established by the fund manager, with a quote once a day.

Money market fund

Bonds issued by enterprises and governments, short-term loans, and interbank deposits.

When the deposit interest rate rises or the reserve requirement ratio rises, the national monetary policy tightens, and the yield of money market funds rises.

The two major indicators for judging a country's monetary policy: deposit interest rates and reserve requirement ratios.

Buy a house or start a business

The indicators of comprehensive financial management: yield, risk, investment cycle, leverage of funds, liquidity, impact of cash flow, financial knowledge.

Indirect investment

Direct investment: real estate, art, venture capital

Entrepreneurship operation: Smile curve (the order of adding value to the store is R&D, brand building, marketing and sales, manufacturing, distribution channels

0 Comments

Next page

Recommended for you

More