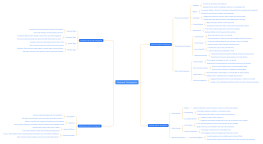

Capital Budgeting Techniques Mind Map

2024-09-04 17:46:48 181 0 Report 0

0

Login to view full content

Other creations by the author

Outline/Content

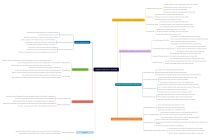

Techniques for Capital Budgeting

Net Present Value (NPV)

Definition

Concept of NPV

Difference between the present value of cash inflows and outflows

Reflects Time Value of Money

Future cash flows are discounted to present value

Calculation

Formula: NPV = Σ (Cash Flow / (1 + Discount Rate)^t) - Initial Investment

Example Calculation

Project A: Initial Investment $100,000, Cash Flows: $30,000, $40,000, $50,000 over 3 years

Advantages

Direct Measure of Added Value

Shows value created for the firm

Considers Time Value of Money

Provides a realistic measure of profitability

Disadvantages

Requires Accurate Forecasting

Dependent on cash flow estimates

Sensitive to Discount Rate Assumptions

Small changes in rate can affect NPV significantly

Internal Rate of Return (IRR)

Definition

Concept of IRR

Discount rate that makes NPV of cash flows zero

Comparison with Cost of Capital

IRR should exceed the cost of capital to be acceptable

Calculation

Finding the Discount Rate that Sets NPV to Zero

Iterative process or financial calculator/software

Example Calculation

Project B: Initial Investment $50,000, Cash Flows: $15,000, $20,000, $25,000 over 3 years

Advantages

Easy to Understand and Communicate

Percentage return is intuitive

Useful for Comparing Projects

Simple comparison of different projects' returns

Disadvantages

Can Be Misleading with Non-Conventional Cash Flows

Multiple IRRs can occur with alternating cash flows

Multiple IRRs in Some Cases

Not unique in certain scenarios

Payback Period

Definition

Concept of Payback Period

Time required to recoup the initial investment

Focus on Liquidity

Measures how quickly the investment can be recovered

Calculation

Formula: Payback Period = Initial Investment / Annual Cash Inflows

Example Calculation

Project C: Initial Investment $40,000, Annual Cash Inflows $10,000

Advantages

Simple to Calculate and Understand

Straightforward and easy to use

Measures Liquidity Risk

Quick assessment of how soon the investment is recovered

Disadvantages

Ignores Time Value of Money

Does not discount future cash flows

Does Not Measure Profitability

Focuses only on recovery time, not total profitability

Discounted Payback Period

Definition

Concept of Discounted Payback Period

Time required to recoup the initial investment using discounted cash flows

Incorporates Time Value of Money

Discounts future cash flows to present value

Calculation

Adjusting Payback Calculation with Discounted Cash Flows

Uses discounted cash flows to calculate payback period

Example Calculation

Project D: Initial Investment $60,000, Discount Rate 10%, Annual Cash Inflows $15,000, $20,000, $25,000

Advantages

More Accurate than Payback Period

Accounts for time value of money

Considers Time Value of Money

Provides a more realistic recovery time

Disadvantages

Still Ignores Cash Flows Beyond Payback Period

Does not consider profitability after the payback period

Profitability Index (PI)

Definition

Concept of PI

Ratio of the present value of cash inflows to the initial investment

Ratio of Present Value of Cash Inflows to Outflows

Indicates relative profitability of an investment

Calculation

Formula: PI = Present Value of Cash Inflows / Initial Investment

Example Calculation

Project E: Present Value of Cash Inflows $80,000, Initial Investment $50,000

Advantages

Useful for Comparing Projects of Different Sizes

Relative measure of profitability

Indicates Relative Profitability

Helps prioritize projects with higher PI

Disadvantages

Less Useful for Mutually Exclusive Projects

May not provide a clear decision if projects are competing for the same resources

Modified Internal Rate of Return (MIRR)

Definition

Concept of MIRR

Adjusts IRR to account for cost of capital and reinvestment rates

Adjustments to IRR Calculation

Provides a more accurate reflection of profitability

Calculation

Formula: MIRR = (Terminal Value of Cash Inflows / PV of Cash Outflows)^(1/n) - 1

Example Calculation

Project F: Initial Investment $70,000, Cash Inflows: $20,000, $30,000, $40,000 over 3 years, Reinvestment Rate 12%

Advantages

Addresses Some IRR Limitations

Corrects for unrealistic IRR assumptions

Provides a More Accurate Measure

Reflects true profitability more accurately

Disadvantages

More Complex to Calculate

Requires additional calculations compared to IRR

Introduction to Capital Budgeting

Definition

What is Capital Budgeting?

Process of planning and managing investments in fixed assets

Evaluates potential major projects or investments

Purpose and Importance

Determines which projects to pursue

Ensures effective allocation of resources

Objectives

Maximizing Firm Value

Increasing shareholder wealth

Long-term financial growth

Allocating Resources Efficiently

Prioritizing profitable projects

Managing risk and returns

Comparing Techniques

NPV vs. IRR

Differences

NPV as a Dollar Amount vs. IRR as a Percentage

NPV provides an absolute value, IRR provides a rate of return

Decision Criteria Differences

NPV: Accept if positive; IRR: Accept if IRR > Cost of Capital

When to Use Each

NPV for Absolute Value

Best for determining the exact value added

IRR for Percentage-Based Comparison

Useful for comparing projects of different scales

Payback Period vs. Discounted Payback Period

Differences

Payback Period vs. Discounted Adjustments

Discounted Payback accounts for time value of money

Cash Flow Consideration Differences

Payback Period ignores future cash flows beyond recovery; Discounted Payback considers discounted cash flows

Applications of Capital Budgeting

Investment Decisions

Evaluating New Projects

Assessing feasibility and profitability of new investments

Asset Replacement

Deciding whether to replace or upgrade existing assets

Risk Assessment

Sensitivity Analysis

Analyzing how changes in key assumptions impact outcomes

Scenario Analysis

Evaluating different scenarios and their impact on project viability

Common Challenges and Solutions

Estimating Cash Flows

Accuracy of Projections

Techniques for Improving Accuracy

Using historical data, market research, expert opinions

Handling Uncertainties

Using Sensitivity and Scenario Analysis

Assessing impact of uncertainties on cash flows

Discount Rate Selection

Choosing the Right Rate

Techniques for Determining Appropriate Rate

Based on cost of capital, risk premium, market conditions

Impact on Results

Sensitivity to Discount Rate Changes

Evaluating how variations in rate affect NPV and other metrics

Collect

Collect

Collect

0 Comments

Next page

Recommended for you

More