Study Notes for Investment

2024-07-06 21:10:51 247 0 Report 0

0

Login to view full content

Other creations by the author

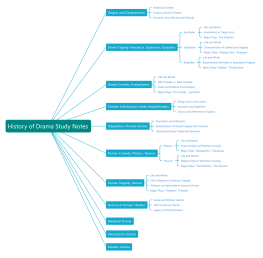

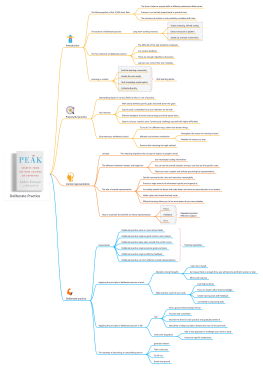

Outline/Content

Introduction to Investments

Definition of Investment

Types of Investments: Stocks, Bonds, Real Estate, Commodities, etc.

Risk and Return: The Investment Tradeoff

Fundamental Concepts

Time Value of Money: Present Value, Future Value, and Compound Interest

Risk Management: Diversification, Asset Allocation

Market Efficiency and Behavioral Finance

Stock Market Investments

Stock Market Basics: Shares, Exchanges, Indices

Valuation Methods: Price-to-Earnings Ratio, Dividend Discount Model

Investment Strategies: Value Investing, Growth Investing, Momentum Investing

Bond Market Investments

Types of Bonds: Government Bonds, Corporate Bonds, Municipal Bonds

Bond Valuation: Yield to Maturity, Coupon Rate

Bond Risks: Interest Rate Risk, Credit Risk

Real Estate Investments

Types of Real Estate Investments: Residential, Commercial, REITs

Real Estate Valuation: Cap Rate, Net Operating Income

Real Estate Financing: Mortgages, Leverage

Alternative Investments

Commodities: Gold, Oil, Agricultural Products

Private Equity and Venture Capital

Hedge Funds and Derivatives

Investment Strategies

Long-Term Investing vs. Short-Term Trading

Passive vs. Active Investing

Portfolio Management: Asset Allocation, Rebalancing

Risk Management

Risk Assessment and Risk Tolerance

Insurance and Hedging Strategies

Contingency Planning and Emergency Funds

Investment Analysis

Financial Statement Analysis: Balance Sheet, Income Statement, Cash Flow Statement

Company and Industry Research

Technical Analysis: Charts, Trends, Indicators

Ethics and Regulation

Code of Ethics for Investors

Regulatory Framework: SEC, FINRA, FCA, etc.

Insider Trading and Market Manipulation

0 Comments

Next page

Recommended for you

More