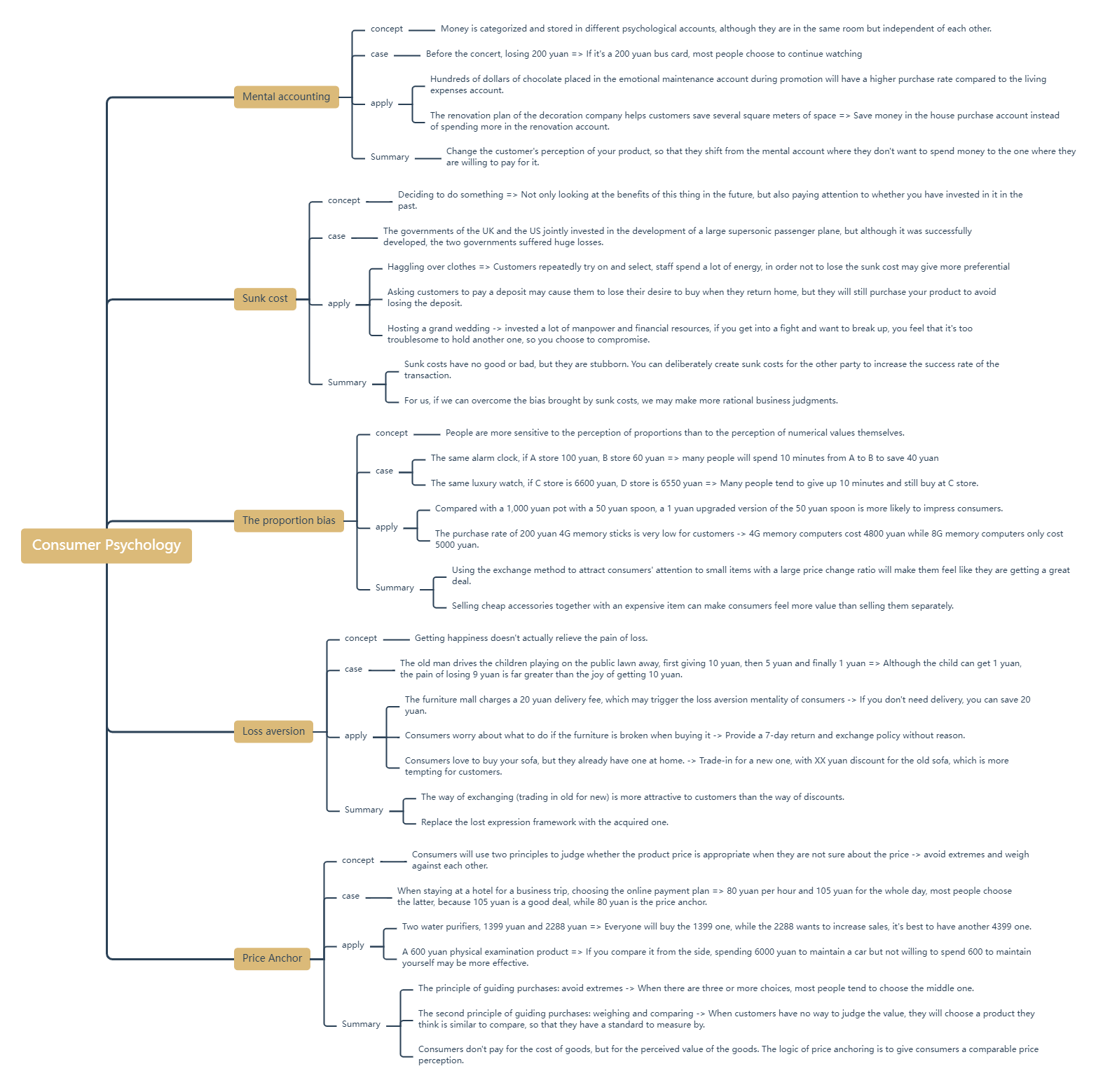

In today's increasingly competitive business, companies not only need high-quality products and services, but also need to deeply understand the psychology of consumers. Consumer psychology, as a discipline that studies consumer behavior and decision-making, reveals many potential psychological motivations and decision-making mechanisms. By mastering these psychological principles, companies can optimize marketing strategies, improve sales performance, and gain an advantage in the market. This article will deeply analyze five core consumer psychology concepts - mental accounting, sunk costs, proportional bias, loss aversion and price anchors, and explore their application in business practice.

Concept and Background:

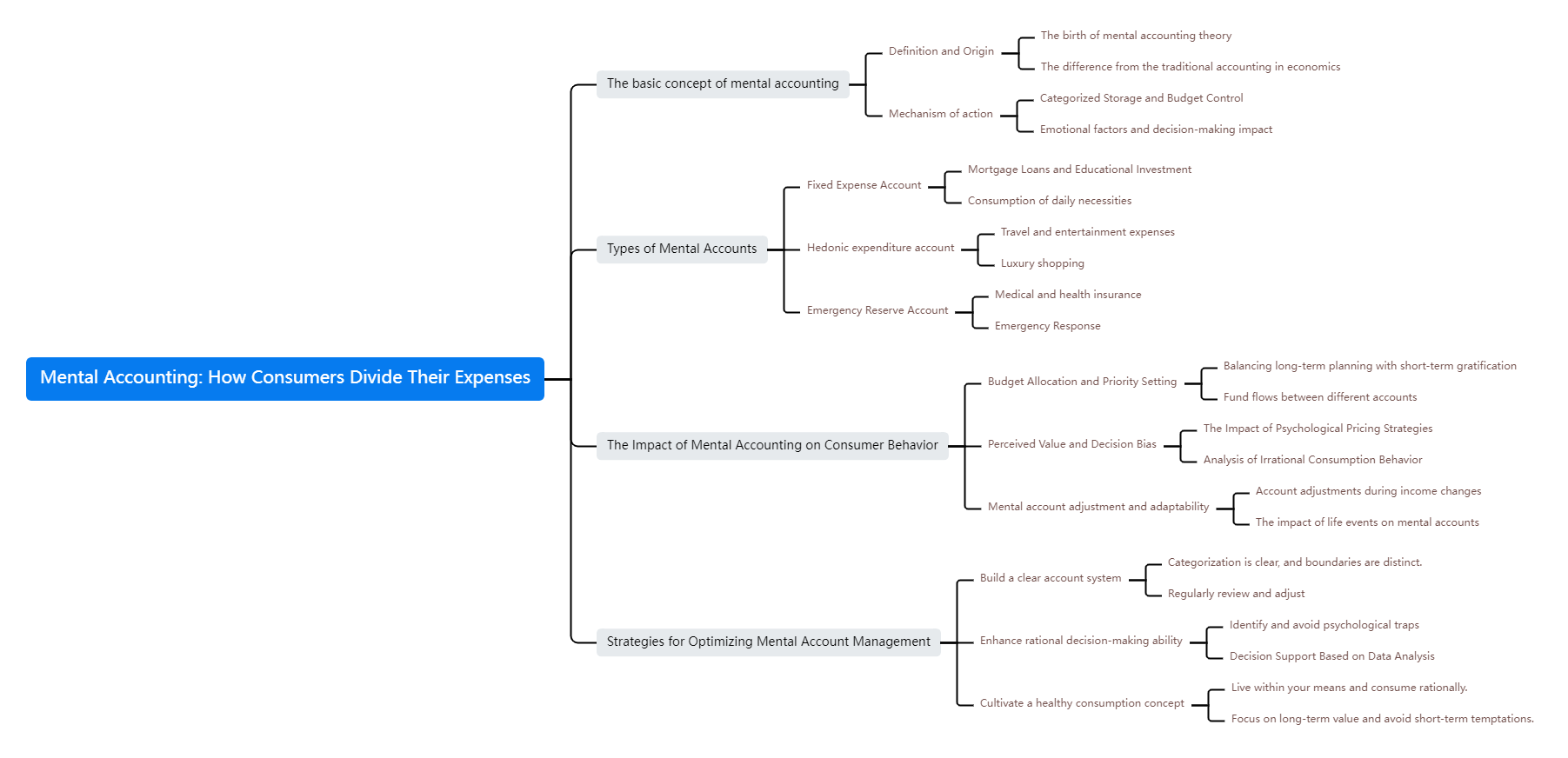

Mental Accounting is a concept proposed by behavioral economist Richard Thaler, which refers to consumers mentally dividing their money into different accounts for management, even if these accounts are financially related. This division helps consumers better control their spending, but it may also lead to irrational decisions.

Applications and cases:

The connection between emotion and consumption: High-end goods such as luxury chocolates usually emphasize their emotional value as gifts in advertisements, prompting consumers to put this expenditure into the "gift" psychological account rather than the "daily expenses" account, thereby increasing their willingness to buy. The balance between rationality and emotion: Home improvement companies can promote the concept of "saving the house purchase budget" and put the decoration expenditure into the "house purchase account", which is easier to attract customers than simply lowering the decoration price.

Summarize:

By carefully designing marketing information, companies can guide consumers to transfer spending from the mental account where they are unwilling to spend to the mental account where they are willing to spend, increasing the likelihood of purchase.

Mental Accounting: How Consumers Divide Their Expenses

Concept and Background:

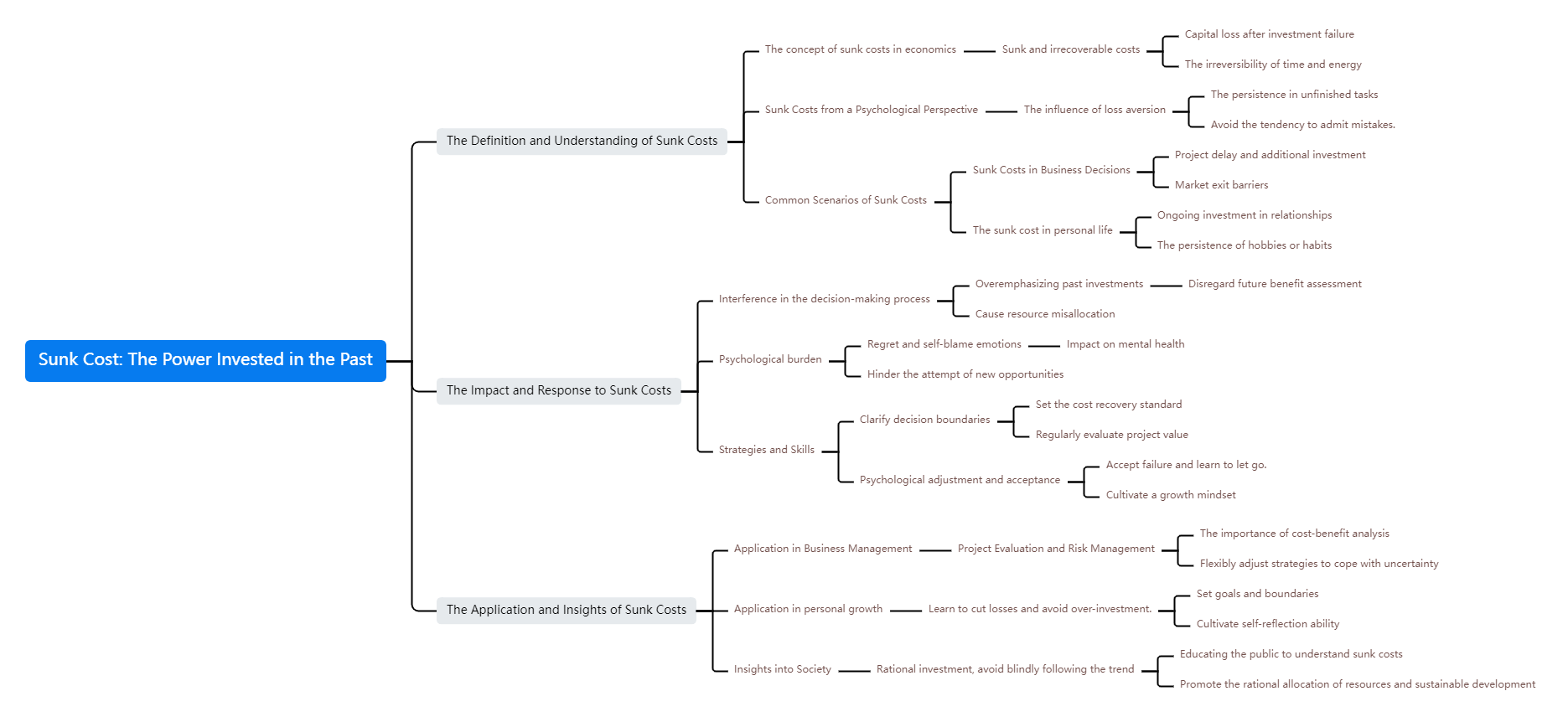

Sunk costs refer to costs that have already been invested and cannot be recovered. Consumers often make decisions to continue investing because they are unwilling to waste these investments. Although sunk costs should not affect future decisions in theory, they often have a strong impact on consumer behavior in practice.

Applications and cases:

Sales skills: When customers spend a lot of time choosing products in a store, the clerk can use the sunk cost psychology to facilitate transactions through slight price concessions, because customers are unwilling to waste the time and energy they have invested. Service guarantee: By collecting deposits or providing unconditional return and exchange services, companies can increase consumers' sunk costs and make them more inclined to continue buying.

Summarize:

By creating or utilizing sunk costs, companies can increase their closing rates. On the other hand, overcoming the impact of sunk costs can help companies be more rational in their investment decisions.

Sunk Cost: The Power Invested in the Past

Concept and background:

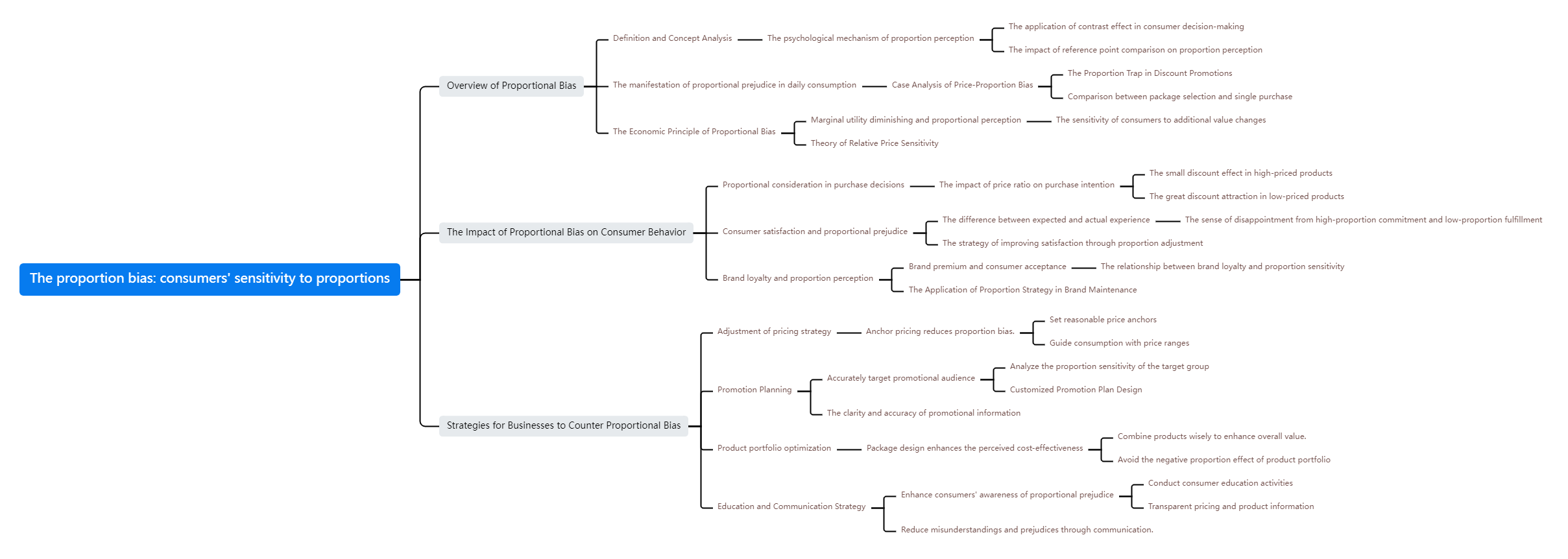

Proportion Bias means that consumers are more likely to respond to changes in proportion rather than changes in absolute value. For example, consumers' perceptions of price changes are more likely to be affected by percentages rather than actual amounts.

Applications and cases:

Promotional strategy: Compared with direct discounts, companies can attract consumers more effectively through “add 1 yuan for redemption” or “buy one, get one free”. For example, when many electronic products are sold, they offer trade-in discounts on small accessories, which significantly increases overall sales. Product mix: By bundling lower-priced items with higher-priced items, companies can take advantage of proportionality bias and make consumers feel that bundled purchases are more cost-effective.

Summarize:

By carefully designing promotion strategies and taking advantage of consumers' sensitivity to proportion changes, companies can effectively increase product appeal and sales.

Proportion Bias: Consumer Sensitivity to Proportion

Concept and Background:

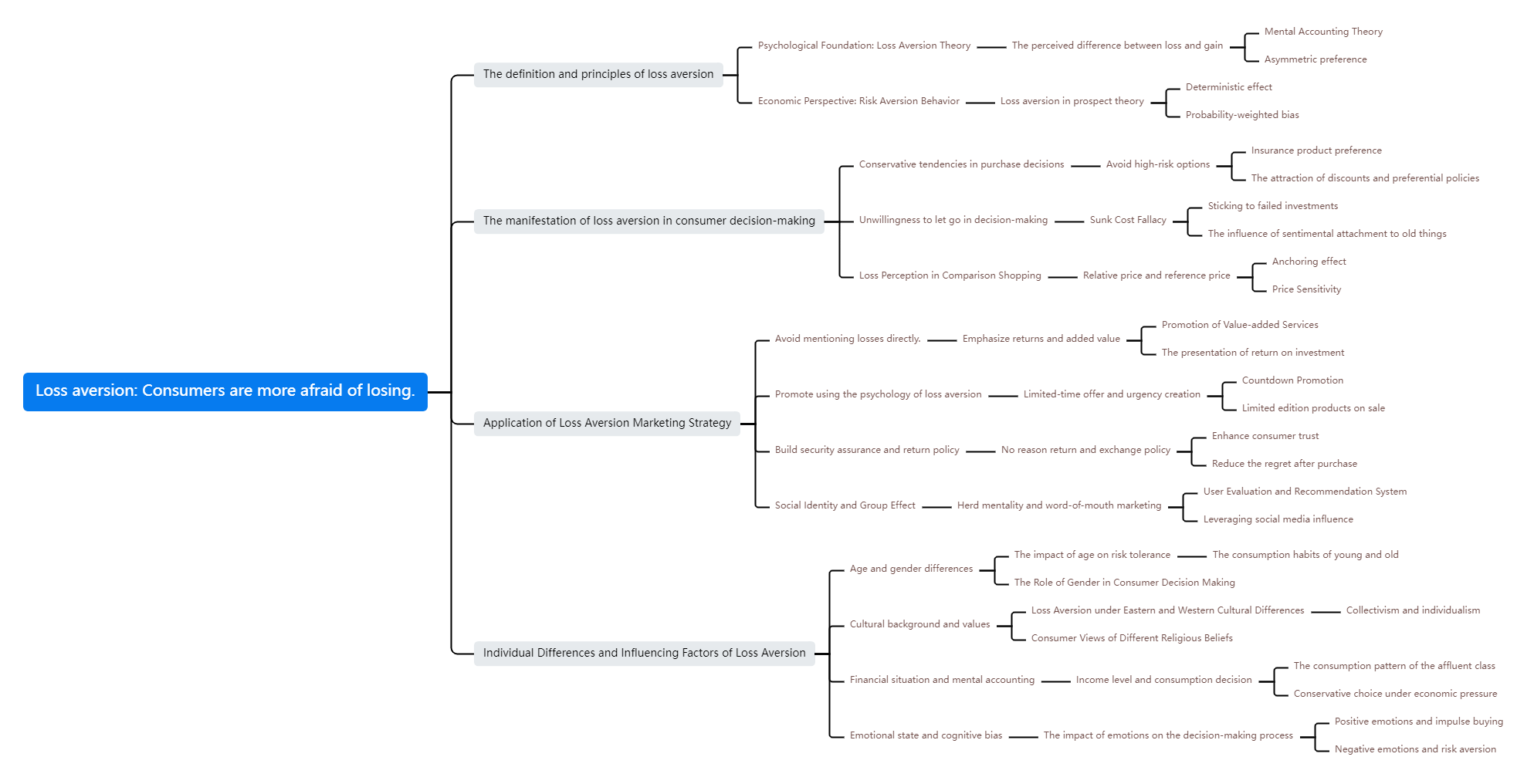

Loss aversion refers to the fact that consumers feel losses much more strongly than gains. This concept was proposed by psychologists Daniel Kahneman and Amos Tversky and explains why people tend to avoid losses rather than pursue gains.

Applications and cases:

Price strategy: In furniture sales, avoid charging delivery fees directly, and instead package it as "20 yuan off immediately", which can effectively reduce consumers' sense of loss. Service design: Providing a "no-reason return and exchange" policy can reduce consumers' concerns about purchases and increase the possibility of purchases. Old-for-new strategy: Compared with simple price discounts, old-for-new allows consumers to feel the benefits of replacing old items with new ones, reducing the pain caused by price losses.

Summarize:

By reducing consumers' sense of loss and through clever wording and service design, companies can significantly increase product appeal and sales.

Loss aversion: consumers are more afraid of losing

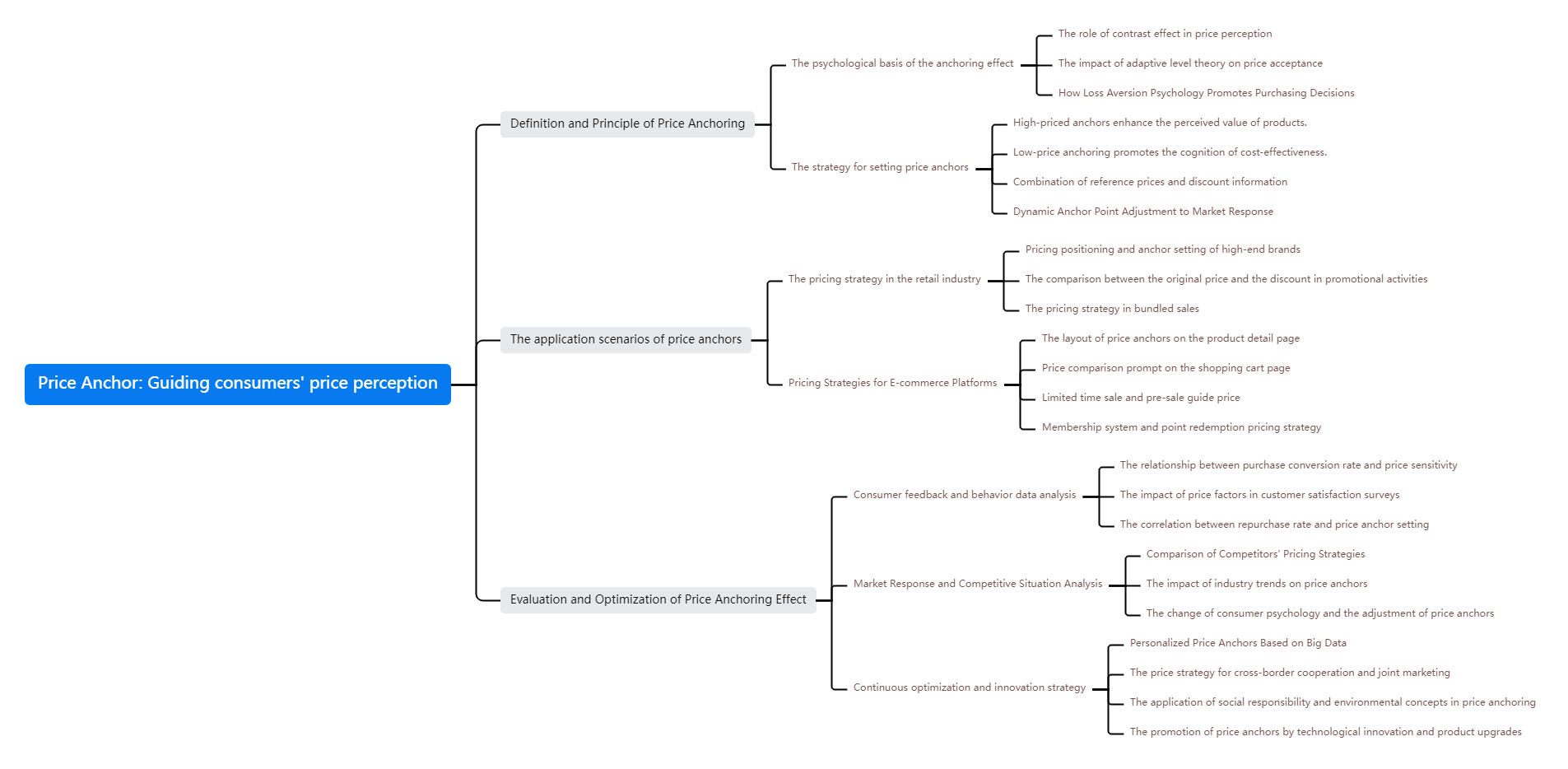

Concept and background:

Price anchoring means that when consumers have no clear idea of the product price, they usually rely on the first price they come across to judge whether other prices are reasonable. This price anchor often significantly affects consumer purchasing decisions.

Applications and cases:

Multi-level pricing: By providing multiple price options, such as high, medium, and low-priced products, companies can use the price anchor effect to induce consumers to choose medium-priced products. For example, when selling water purifiers, you can set a higher-priced option as an anchor to guide consumers to choose the second-highest-priced product. Price comparison: By showing the comparison between high-priced and medium-priced products, companies can guide consumers to choose relatively more cost-effective medium-priced products, thereby increasing sales.

Summarize:

The use of price anchors can effectively guide consumers' price perception, making them more inclined to choose products that the company wants them to buy, thereby increasing overall profits.

Price Anchor: Guiding Consumers’ Price Perception

After deeply understanding and applying the key concepts in consumer psychology, companies can more accurately grasp consumer psychology, develop more effective marketing strategies, improve customer satisfaction, and thus stand out in the fiercely competitive market. Through the analysis and application of mental accounts, sunk costs, proportional bias, loss aversion and price anchors, companies can not only increase sales, but also establish more lasting customer relationships and achieve long-term business success.

Through in-depth analysis and innovative application of consumer psychology, companies can find new ways to enhance their competitiveness in a rapidly changing market environment and lay a solid foundation for long-term development.