Factory business bracket diagram

2024-11-12 11:03:04 128 0 Report 0

0

Login to view full content

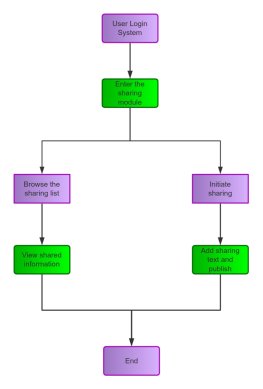

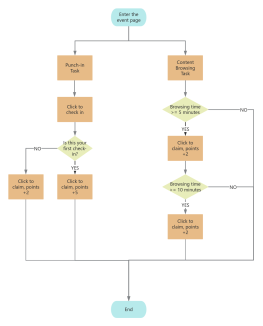

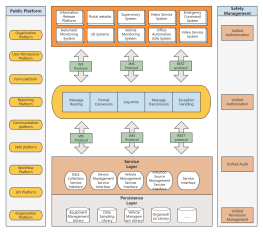

The 'Factory Business Bracket Diagram' mind map provides a comprehensive overview of factory operations with a focus on profitability. It outlines key areas such as main business income from various product lines, including HR, lubricant, OPE, and UCP products. The mind map delves into cost structures, emphasizing the importance of standard and actual cost management. It explores strategies for maintaining and increasing profitability through markup rates, production capacity management, and strategic pricing. Additionally, it highlights the impact of four major expenses—sales, administrative, financial, and R&D—on net profit, while also considering cash flow, inventory management, and continuous cost reduction strategies.

Other creations by the author

Outline/Content

Main Business Income

HR products

Lubricant products

OPE products

UCP Product

Main business cost (standard cost + actual cost difference)

Standard Cost

Step cost: Achieve step cost price according to the amount

Standard cost ensures accuracy

Working Hours: The working hours for products in the same series are the same, and the differences are in different configurations.

Purchased price: guaranteed accurate and reasonable

BOM changes are promptly transferred to cost, and the standard cost is changed simultaneously.

Actual cost variance

Quantity difference

Fee difference

Price difference

Main business profit

Gross profit from main business = Main business revenue - Actual cost

Gross profit from main business = Quoted profit + Actual cost difference

Gross profit from main business = Quoted profit + Actual cost difference

Actual cost = standard cost + actual cost variance = actual material input (BOM feeding) + manufacturing cost input + material price variance

Quotation Profit

The markup rate determined by different product lines

Premium rate

The company determines the initial markup rate.

When production capacity is insufficient

The number of orders received in the current month exceeds the break-even production volume.

High-profit products are priced according to the company's determined markup rate.

Products with low profit margins can increase their profitability by raising their markup.

The monthly order intake is below the break-even production volume.

Offering discounts to attract more orders and increase revenue and sales.

Increase production capacity

When production capacity is sufficient

The number of orders received that month exceeds the break-even production volume.

Open source: Offering discounts to attract more orders and sales, reducing the markup rate.

Throttling: If orders cannot be obtained, reduce expenses and reduce variable costs.

The order volume for the month is below the break-even production capacity.

Open Source: Discount Promotion, Increase Rate Reduction

Throttling: If unable to obtain orders, reduce expenses, reduce fixed costs

Profit contribution point product

Celebrity products

High-profit products

High-selling products - positioning strategy focuses on cost reduction

High-profit products - positioning strategy appropriately reduces the markup rate to obtain more volume

Loss-making products

Products with strategic loss of meaning

The retention - positioning strategy is to achieve no loss or minimal loss

High-cost products or non-competitive products

The selling price is competitive: raise the selling price for products in demand, and take off the shelves for products without demand.

Price is not competitive: off the shelf

Four expenses

Sales Expenses - After-sales Expenses

Cost of quality loss due to post-sales parts or product costs

After-sales service fee

Return shipping fee

Administrative Expenses

Non-production unit expenses

Financial expenses

Capital Occupation Fee

Settlement, etc.

R&D expenses

According to the actual occurrence of the project

Other Operating Revenue

The net profit of the factory = the main business profit - the four expenses + the income from other businesses

Cash flow

Accounts Payable

Billing period

Payment Method

Accounts Receivable

Billing period

Payment Method

inventory

raw materials

Work in progress

Finished products

Continuous cost reduction

Continuous optimization of product structure

The continuous upgrading of the working method

The continuous improvement of team capabilities

Continuous optimization of the supply chain

Create hot products + star products

Based on market demand and positioning, we promote products at the most competitive price while ensuring quality, and achieve final revenue through volume.

0 Comments

Next page

Recommended for you

More