Investment Consultant Consultation Framework

2024-07-07 12:35:23 304 0 Report 0

0

Login to view full content

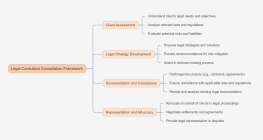

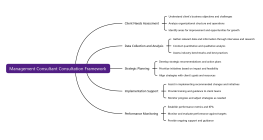

This mind map outlines a comprehensive framework for investment consultant consultations, focusing on key areas to optimize client satisfaction and investment performance. It starts with a thorough Client Assessment, including understanding client goals and risk tolerance, analyzing their financial situation, and identifying specific investment objectives. The Investment Strategy phase involves developing a tailored investment plan, asset allocation, and portfolio diversification to mitigate risks. Portfolio Management is an ongoing process where investment performance is monitored, portfolios are rebalanced, and tax-efficient strategies are implemented. Effective Client Communication is essential, providing regular updates, educating clients on investment decisions, and addressing any concerns. This structured approach ensures a personalized and effective investment consulting service.

Other creations by the author

Outline/Content

Client Assessment

Understand Client Goals and Risk Tolerance

Analyze Financial Situation

Identify Investment Objectives

Investment Strategy

Develop Investment Plan

Allocate Assets

Diversify Portfolio

Portfolio Management

Monitor Investment Performance

Rebalance Portfolio

Implement Tax-Efficient Strategies

Client Communication

Provide Regular Updates

Educate Clients on Investment Decisions

Address Client Concerns

Collect

Collect

0 Comments

Next page

Recommended for you

More