Mental Accounting: How Consumers Divide Their Expenses

2024-09-26 10:56:31 186 3 Report 0

0

Login to view full content

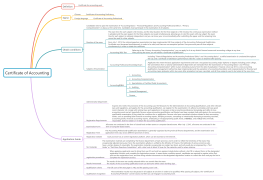

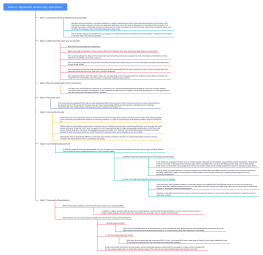

This mind map explores the intricate concept of mental accounting, a theory that examines how consumers mentally categorize and manage their expenses. Unlike traditional economic accounting, mental accounting delves into the psychological mechanisms influencing budget control and decision-making. It categorizes expenses into distinct accounts such as fixed expenses, hedonic expenditures, and emergency reserves. The map also highlights the impact of mental accounting on consumer behavior, including budget allocation, perceived value, and decision bias. Furthermore, it offers strategies for optimizing mental account management, emphasizing the importance of rational decision-making and fostering a healthy consumption mindset.

Other creations by the author

Outline/Content

The basic concept of mental accounting

Definition and Origin

The birth of mental accounting theory

The difference from the traditional accounting in economics

Mechanism of action

Categorized Storage and Budget Control

Emotional factors and decision-making impact

Types of Mental Accounts

Fixed Expense Account

Mortgage Loans and Educational Investment

Consumption of daily necessities

Hedonic expenditure account

Travel and entertainment expenses

Luxury shopping

Emergency Reserve Account

Medical and health insurance

Emergency Response

The Impact of Mental Accounting on Consumer Behavior

Budget Allocation and Priority Setting

Balancing long-term planning with short-term gratification

Fund flows between different accounts

Perceived Value and Decision Bias

The Impact of Psychological Pricing Strategies

Analysis of Irrational Consumption Behavior

Mental account adjustment and adaptability

Account adjustments during income changes

The impact of life events on mental accounts

Strategies for Optimizing Mental Account Management

Build a clear account system

Categorization is clear, and boundaries are distinct.

Regularly review and adjust

Enhance rational decision-making ability

Identify and avoid psychological traps

Decision Support Based on Data Analysis

Cultivate a healthy consumption concept

Live within your means and consume rationally.

Focus on long-term value and avoid short-term temptations.

Collect

0 Comments

Next page

Recommended for you

More